- Trading

- Instrument Specifications

- Synthetic Instruments Library

- Gold vs Russian Ruble Investing

Gold vs Russian Ruble - XAU RUB Trading

Gold vs Russian Ruble Investing

Type:

PCIInstrument : &XAURUB

Gold Ruble Description

The personal composite instrument «XAURUB» reflects the price dynamics of gold against Russian ruble. The base part of this instrument is composed of 1 ounce of gold, and the quoted part – 1 Russian ruble. The asset percentage content of the instrument is estimated on the basis of asset prices on the instrument creation date.

The trading instrument &XAURUB is used for the analysis and trade of gold quoted against Russian ruble. A considerable part of official reserves in Russian economy are held in gold.

Structure

Parameters

Trading hours

Application field

Structure

| &XAURUB | № | Asset | Volume / 1 PCI | Percentage | Volume (USD) / 1 PCI | Unit of measurеment |

|---|---|---|---|---|---|---|

| Base part | 1 | XAU | 1.0000 | 1.200 | 1197.0100 | oz |

| Quoted part | 1 | RUB | 1.000 | 0.0000 | 0.0200 | RUB |

Parameters

| Standard | Beginner | Demo | |

|---|---|---|---|

| Fixed spread, pip | |||

| Floating Spread, pip | |||

| Order distance, pip | |||

| Swap (long/short) in pips on Vol | |||

|

Available volumes | |||

| The value of 1 pip in USD for the Vol |

Trading hours

| Week day | Trading hours (CET) | Local trading hours |

| Monday | 00:00 — 24:00 | 00:00 — 24:00 |

| Tuesday | 00:00 — 24:00 | 00:00 — 24:00 |

| Wednesday | 00:00 — 24:00 | 00:00 — 24:00 |

| Thursday | 00:00 — 24:00 | 00:00 — 24:00 |

| Friday | 00:00 — 22:00 | 00:00 — 22:00 |

| Saturday | — | — |

| Sunday | — | — |

Application field

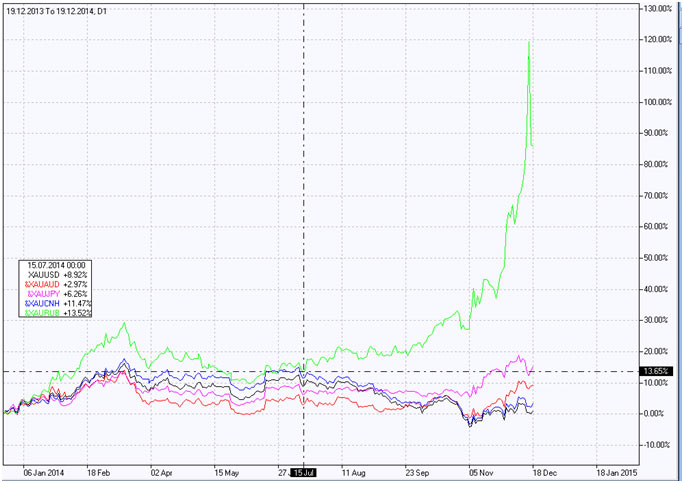

The personal composite trading instrument &XAURUB is used for trade and dynamics analysis of gold vs Russian ruble, as well as multi-year comparative analysis of gold vs. other currencies. For example, by building a percentage chart in the NetTradeX terminal for 5 instruments which quote the price of gold in various currencies - XAUUSD, &XAUJPY, &XAUJPY, &XAUCNH and &XAURUB (Fig.1 ), it is evident that during the recent year gold advanced against ruble, rising gradually at first and then proceeding to climb sharply starting from July 2014, while at the same time retreating a little bit against other currencies.

Traders, whose main assets and investments are denominated in rubles, will be comfortable trading this PCI.

To trade PCI instruments offered exclusively by IFC Markets, you need to open a free account and download the NetTradeX platform.

- Clients Also Trade These Instruments