- Trading

- Instrument Specifications

- Synthetic Instruments Library

- Canadian Dollar Index Investing

Canadian Dollar Index - CAD Index

Canadian Dollar Index Investing

Type:

PCIInstrument : &CAD_Index

Canadian Dollar Index Description

The Canadian Dollar Index (CAD Index) demonstrates the connection between the Canadian dollar (CAD) and other prominent currencies. Given that the CAD is classified as a commodity currency, its value is notably influenced by commodity prices. Additionally, a crucial factor is its extensive trading partnership with the United States. This relationship becomes evident upon closer examination.

In cases where trade volumes diminish due to various reasons, there could be adverse implications for CAD exchange rates and the CAD index.

The CAD Index is a useful tool for tracking the performance of the Canadian dollar and for analyzing trends in the foreign exchange market. It is a reliable indicator of the value of the Canadian dollar and is a transparent and liquid index.

Advantages and Key Points of CAD Index

- The CAD Index is a weighted average of the exchange rates of the Canadian dollar against six major currencies: the euro (EUR), US dollar (USD), British pound (GBP), Australian dollar (AUD), Swiss franc (CHF), and Japanese yen (JPY).

- The weights of the currencies in the index are determined by their relative importance in trade and investment between Canada and other countries.

- The CAD Index is a reliable indicator of the value of the Canadian dollar and is calculated using a consistent methodology.

- The CAD Index is also a transparent index, with the methodology for calculating it being publicly available.

- Additionally, the CAD Index is a liquid index, with there being a lot of trading activity in it. This makes it easy to buy or sell CAD Index contracts.

- The CAD Index can be used to track the performance of the Canadian dollar and to analyze trends in the foreign exchange market.

- The CAD Index can also be used to make informed trading decisions.

- Changes in interest rates: When interest rates in Canada rise, the CAD Index tends to appreciate. This is because investors are more likely to invest in Canadian assets when interest rates are higher.

- Changes in economic growth: When the Canadian economy is growing strongly, the CAD Index tends to appreciate. This is because investors are more likely to invest in Canadian assets when the economy is doing well.

- Changes in commodity prices: Canada is a major exporter of commodities, so changes in commodity prices can have a significant impact on the CAD Index. When commodity prices rise, the CAD Index tends to appreciate.

- Political events: Political events in Canada or other countries can also affect the CAD Index. For example, if there is a political crisis in Canada, the CAD Index could decline.

Structure

Parameters

Trading hours

Application field

Structure

| &CAD_Index | № | Asset | Volume / 1 PCI | Percentage | Volume (USD) / 1 PCI | Unit of measurеment |

|---|---|---|---|---|---|---|

| Base part | 1 | CAD | 1005.9120 | 80.000 | 800.0000 | CAD |

| Quoted part | 1 | AUD | 251.214 | 19.5500 | 195.5000 | AUD |

| 2 | CHF | 179.694 | 19.5500 | 195.5000 | CHF | |

| 3 | EUR | 164.354 | 18.6400 | 186.4000 | EUR | |

| 4 | GBP | 129.535 | 19.5500 | 195.5000 | GBP | |

| 5 | JPY | 23031.924 | 19.5300 | 195.3000 | JPY | |

| 6 | USD | 31.800 | 3.1800 | 31.8000 | USD |

Parameters

| Standard | Beginner | Demo | |

|---|---|---|---|

| Fixed spread, pip | |||

| Floating Spread, pip | |||

| Order distance, pip | |||

| Swap (long/short) in pips on Vol | |||

|

Available volumes | |||

| The value of 1 pip in USD for the Vol |

Trading hours

| Week day | Trading hours (CET) | Local trading hours |

| Monday | — | — |

| Tuesday | — | — |

| Wednesday | — | — |

| Thursday | — | — |

| Friday | — | — |

| Saturday | — | — |

| Sunday | — | — |

Application field

In the foreign exchange turnover study carried out by the Bank of International Settlement in April 2013 7 leading currencies, which we have included for considering, stand out in monthly exchange turnover volumes.

| Currency | Turnover share, % |

|---|---|

| USD | 43.5% |

| EUR | 16.7% |

| JPY | 11.5% |

| GBP | 5.9% |

| AUD | 4.3% |

| CHF | 2.6% |

| CAD | 2.3% |

Тable 1. Central bank foreign turnover. April 2013.

In the right hand column the respective shares of currencies in the foreign exchange turnover of regulators are presented in descending order.

In creating the index we consider (quote) CAD against “portfolio standard”, composed of 6 remaining liquid currencies: USD + GBP + EUR + AUD + CHF + JPY. The weight optimization is carried out so that the standard possesses the minimum sensitivity with respect to the events in Canada. The weights, which correspond to the quoted standard, are selected on the basis of currency zone “non-interference” principle.

Let us explain the application of that principle. The table of liquid currency priority for foreign exchanges quoted against CAD is made on the basis of foreign exchange turnover 2013 study where we apply a numerically small value 0.1% for the turnover share of the currencies not presented in the source.

| Currency pair | Turnover share, % | Residual influence share, % |

|---|---|---|

| USD/CAD | 3.7 | 0.7 |

| GBP/CAD | 0.1 | 4.3 |

| AUD/CAD | 0.1 | 4.3 |

| CAD/CHF | 0.1 | 4.3 |

| EUR/CAD | 0.3 | 4.1 |

| CAD/JPY | 0.1 | 4.3 |

Тable 2. Currency pair monthly turnover. April 2013.

The total share of CAD turnover relative to the liquid instruments under consideration is 22.2%. Then the residual share is equal to the difference between the total share and the currency pair share.

The residual share characterizes the currency (CAD) stability with respect to changes in the price of the quoted part. Indeed, in order to introduce significant volatility into the index the participation of remaining “counterpart” currencies (CAD vs X) is required with the weights equal to their share in the foreign exchange operations. Therefore the values from the right hand column of the Table 2 were applied for determining the currency weights for creation of the index.

Let us remind that the structure of the index can be represented as follows:

CAD / ( W1*USD + W2*GBP + W3*AUD + W4*CHF + W5*EUR + W6*JPY )

We shall take the Wi weights for the standard proportional to the residual influence share (the right hand column of the Table 2). Thus, we are raising the index stability with respect to events in Canada. Then the index sensitivity will be determined by the base part – CAD. The estimates yield the percentage composition of the portfolio, presented in the Structure table.

The instrument & CAD _Index is highly sensitive with respect to fundamental changes in Canada’s economic development and therefore well suited for trend following strategy in periods when key fundamental events are anticipated.

In NetTradeX trading platform buying the instrument means capital allocation between a long position in CAD and a short position in the portfolio standard.

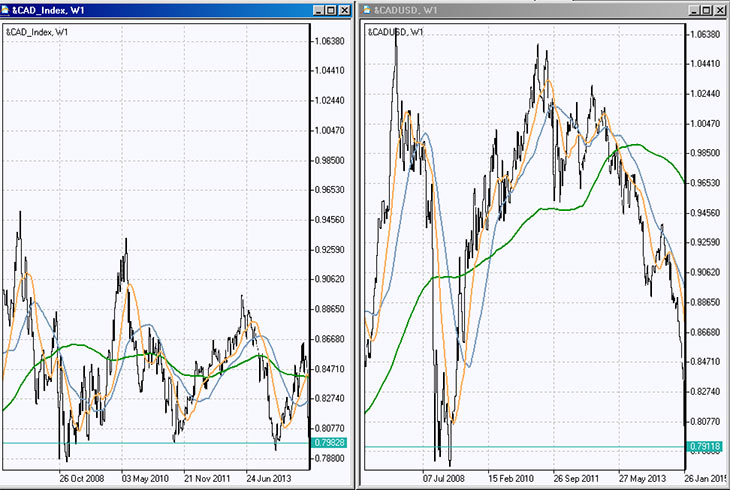

&CAD_Index can be used for comparative analysis of the index vs. the instrument &CADUSD (the reciprocal of the popular currency pair USDCAD), by building, for example, a percentage chart in the NetTradeX terminal for the two instruments (Fig.1) and studying the price dynamics during 2014. It is evident that since the end of the summer of 2014 the Canadian dollar and American dollar currency pair started to fall much faster than the index, which allows to make a conclusion, for example, that the USD was the main contributor to the fall.

Fig. 1

By comparing the price dynamics of the index and the currency pair for long-term trade (Fig.2) it is evident that the CAD index range (on a weekly timeframe) is two times smaller than the &CADUSD range.

Fig. 2

Traders, who specialize in fundamental analysis and focus on the developments in Canada’s economy and want to filter out the influence of other currency zones will be comfortable trading this instrument.

To trade PCI instruments offered exclusively by IFC Markets, you need to open a free account and download the NetTradeX platform.

- Clients Also Trade These Instruments