- Analytics

- Technical Analysis

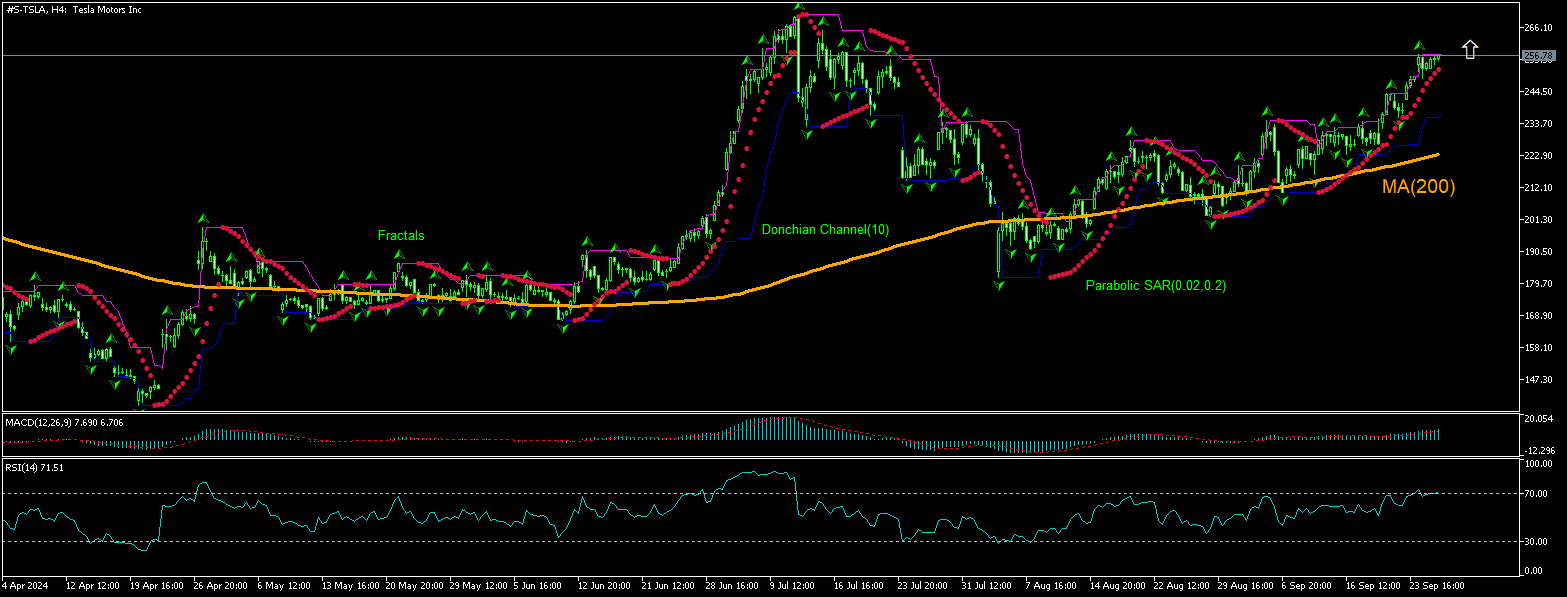

Tesla Technical Analysis - Tesla Trading: 2024-09-26

Tesla Technical Analysis Summary

Above 256.91

Buy Stop

Below 237.24

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Tesla Chart Analysis

Tesla Technical Analysis

The technical analysis of the Tesla stock price chart on 4-hour timeframe shows #S-TSLA: H4 hit nine-week high above the 200-period moving average MA(200) yesterday after rebounding from three-months low it hit seven week ago. The RSI has entered into in the overbought zone. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 256.91. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 237.24. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (237.24) without reaching the order (256.91), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Tesla

Tesla stock closed higher despite filings showing Chief Financial Officer sold company stock worth over $2 million. Will the Tesla stock price continue rebounding?

Tesla SEC filings revealed that CFO Vaibhav Taneja executed transactions on September 23 that resulted in the sale of Tesla shares totaling over $2 million. The stock however closed over 1% higher over day after the news. Sales of substantial holdings of company stock by top executives are bearish for company stock price as stock transactions by company insiders are closely watched to help gauge company insider confidence in enterprise. At the same time, investment banks have maintained lately high Tesla ratings as they project high third-quarter deliveries. Thus, Piper Sandler has revised Tesla's price target from $300 to $310, citing an upward revision in vehicle delivery estimates for the third quarter and full year 2024. The firm predicts Tesla will reach nearly 459,000 deliveries in the third quarter, marking a quarter-over-quarter increase of 3.3% and a year-over-year growth of 5.4%. And Baird and RBC Capital have maintained their Outperform ratings on Tesla, projecting third-quarter deliveries at approximately 480,000 and 460,000 units, respectively.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.