- Education

- About Forex

- An order book

An Order Book

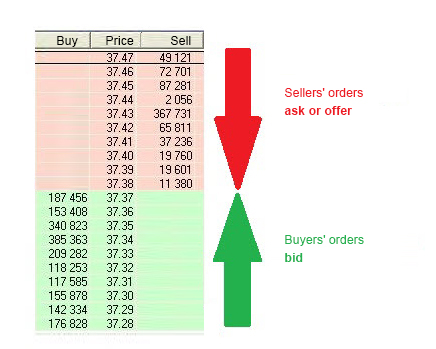

An order book is a list of current orders for one asset set by traders, which displays the buy and sell orders for an asset on an exchange in real time. Based on the analysis of an order book, it is possible to make a short-term market outlook.

How is an order book formed?

In order to make a deal on an exchange, the trader sends an order through the trading terminal specifying the parameters of the future transaction: buy or sell, necessary volume of the asset and the desired price. When an exchange receives the order, the automatic search for a counter order starts, and in case it is detected, the deal is made. In case of the absence of a counter order, the received order is entered into an order book and waits for a counter order. A large number of orders is made in sequence depending firstly on the offered price and then, on the time of entering an exchange. An order book consists of two columns: the first column includes the Bid or Ask price of the asset and the second one includes the volume of orders offered by participants.

In the upper section of the following order book are displayed orders for sale, and on the bottom – orders for the purchase of an asset. Market prices or the best prices offered by sellers and buyers are between the orders of sellers and buyers. The difference between the best Bid and Ask prices is called the spread.

Orders can be divided into the following types:

- Limit orders – these are common orders, which indicate the type of the asset, the price and the desired volume of the transaction;

- Market orders – these are buy or sell orders for an asset at the best current market price and desired volume.

- Conditional orders – any order, except limit orders, which requires the execution of certain conditions set by participants.

Only limit orders are included in the order book, since market orders are executed instantly at the current market price, and conditional orders remain invisible until set conditions are fulfilled and then they become either limit or market orders.

The usage of an order book

By analyzing the order book, a trader will be able to understand how the current price was formed, how the buy and sell orders of an asset are currently distributed, what is the best price level and volume to enter the market.

For instance, if there is a disproportionate number of sell orders near the upper boundary of the price channel, this may mean (but not necessarily) that traders have bought assets at the lower boundary of the channel and are going to sell them at the upper boundary. This means that the market will soon rise to the upper boundary, and then it will fall under the pressure of high sell volumes. Thus, if there is a noticeable accumulation of orders in the order book, then there is a high probability of “attraction” of prices to this accumulation, and then a price bounce.