- Analytics

- Market Overview

US equities pull back - 17.1.2018

All three main US indices slip

US stock indices pulled back on Tuesday after switching between gains and losses as concerns about possible government shutdown weighed on market sentiment. The dollar weakening halted: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose less than 0.1% to 90.474. The S&P 500 lost 0.4% to 2776 led by energy and materials shares. Dow Jones industrial average slipped less than 0.1% to 25792. The Nasdaq composite index fell 0.5% to 7223.69. Futures on main US stock indices indicate higher opening today.

Investors’ risk appetite was dampened on concerns government may shut down as it runs out of money on Friday if Congress cannot agree on a short-term spending bill. Concerns intensified after a bipartisan immigration deal was rejected by President Donald Trump last week. Weaker than expected economic data didn’t provide support for renewed optimism either: the Empire State manufacturing index fell to 17.7 in January, from upwardly revised 19.6 in December.

Weaker euro lifts European stocks

European stocks advanced on Tuesday lead by exporter shares as euro halted its advance against the dollar. The British Pound joined the euro in pullback against the dollar. The Stoxx Europe 600 gained 0.1%. The German DAX 30 rose 0.4% to 13246.33. France’s CAC 40 added 0.1% while UK’s FTSE 100 slipped 0.2% to 7755.93. Markets opened mixed today.

Euro reversed its ascent against the dollar on news the European Central Bank was unlikely to revise its promise to continue its 2.55 trillion euro bond purchases program at next week’s meeting. The ECB meets next Thursday on January 25 and there were reports the central bank may shift to a more hawkish stance in light of improving growth in the euro-zone. This fueled the euro rally. ECB governing council member François Villeroy de Galhau also said monetary stimulus should see a gradual.

Asian stocks lower

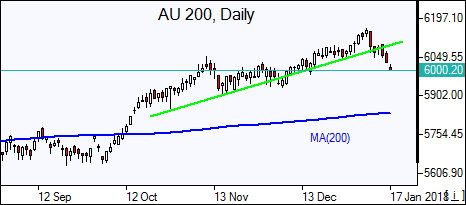

Asian stock indices are mostly lower today. Nikkei fell 0.4% to 23850 with resumed yen strengthening against the dollar. Chinese stocks are higher despite a government crackdown on shadow banking: the Shanghai Composite Index is up 0.3% while Hong Kong’s Hang Seng Index is 0.1% lower. Australia’s All Ordinaries Index is down 0.5% with Australian dollar steady against the greenback.

Oil falls

Oil futures prices are retreating today on concerns prices are overstretched after more than 13% gain over the past month. The Energy Information Administration will release its US inventory data on Thursday, a day later than usual because of Monday’s Martin Luther King Jr. holiday. Trade group the American Petroleum Institute will release its own figures late today. Prices fell Tuesday: March Brent lost 1.6% to $69.15 a barrel Tuesday.

See Also