- Analytics

- Market Overview

Thin trading expected as US markets reopen - 24.11.2017

US stock indices futures up

US markets reopen today after Thanksgiving holiday. Stock index futures point to markets opening higher. Trading closes early today with roughly half of normal trading volumes expected. The dollar weakened yesterday as Fed minutes indicated the pace of future rate hikes may be slower as policymakers are wary of sluggish inflation: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended 0.2% lower at 93.1.

Euro-zone data support European stocks

European stocks ended marginally higher paring earlier losses on Thursday on positive economic data. The euro extended gains against the dollar while British Pound ended lower. The Stoxx Europe 600 index rose less than one point. Germany’s DAX 30 lost 0.5% to 13008.55 after 1.2% loss Wednesday. France’s CAC 40 rose 0.5% while UK’s FTSE 100 slipped less than 0.1% to 7417.24. Indices opened higher today.

Positive economic reports supported stock indices: euro-zone services and manufacturing activity beat forecasts as the Composite Purchasing Managers Index for November rose to 57.5, its highest level since April 2011. Germany’s gross domestic product grew at a 0.8% quarter-to-quarter rate in the three months through September, confirming preliminary growth estimates. And France’s manufacturing confidence rose to a fresh decade high, in line with expectations.

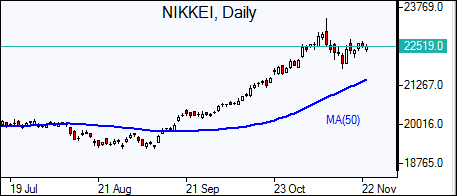

Asian markets up

Asian stock indices are mostly higher today. Nikkei rose 0.1% to 22552 supported by renewed yen weakness against the dollar. Chinese stocks are rising paring earlier losses after People’s Bank of China injected a net 20 billion yuan ($3.04 billion) into money markets after Thursday’s 100 billion yuan. The Shanghai Composite Index is 0.01% higher and Hong Kong’s Hang Seng Index is up 0.5%. Australia’s All Ordinaries Index is down 0.1% despite weaker Australian dollar against the greenback.

Oil advances

Oil futures prices are edging higher today on tighter US supply after shutdown of the 590,000 barrel per day Keystone crude oil pipeline from Canada to the United States. Prices were little changed yesterday: Brent for January settlement fell 3 cents to end the session at $63.29 a barrel on Thursday.

See Also