- Analytics

- Market Overview

US stocks rally as retail sales rise - 15.1.2018

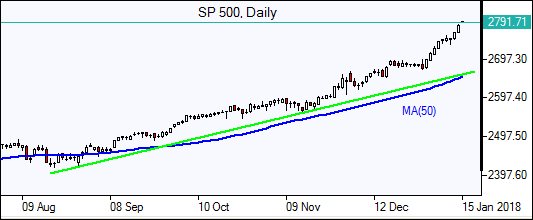

All three main stock indices close at records

US stock indices ended at record highs but dollar slumped on Friday as retail sales rose while inflation remained unchanged in December. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 1% to 90.926 Friday. S&P 500 gained 0.7% to fourth straight closing record 2786.24 as retail sales rose 0.4% in December. The US broad market index gained 1.6% for the week. Dow Jones industrial average jumped 0.9% to fresh record 25803.19. The Nasdaq composite added 0.7% to 7261. Futures indicate higher market openings today.

European stocks recover on German progress

European stock indices rebounded on Friday with market sentiment buoyed by progress in German coalition government talks. The euro rallied against the dollar as German Chancellor Angela Merkel’s conservative CDU party reached an initial deal with center-left SPD for formal coalition negotiations. The Stoxx Europe 600 index rose 0.3% up 0.3% for the week. The DAX 30 added 0.3% to 13245.03. France’s CAC 40 jumped 0.5% and UK’s FTSE 100 gained 0.2% to fresh record 7778.64. Indices opened mixed today.

Asian markets mixed

Asian stock indices are mixed today. Nikkei ended 0.3% higher at 23715 despite continued yen strength against the dollar. Chinese stocks are lower: the Shanghai Composite Index is down 0.5% and Hong Kong’s Hang Seng Index is 0.2% lower. Australia’s All Ordinaries Index is up 0.1% despite continued Australian dollar climb against the greenback.

Oil higher

Oil futures prices are edging higher today. Prices ended higher Friday supported by consecutive US crude stock weekly draws: March Brent rose 0.9% to $69.87 a barrel on Friday. It gained 3.3% in the week.

See Also