- Analytics

- Market Overview

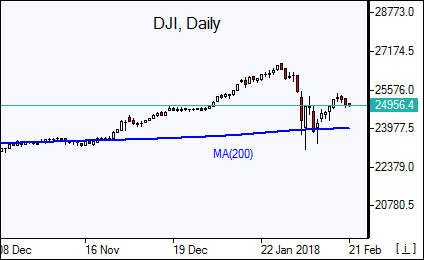

US stocks end lower - 21.2.2018

Dow, S&P 500 snap 6-day win streak

US stocks ended lower Tuesday after markets opened following Presidents Day holiday. The S&P 500 lost 0.6% to 2716.26. Dow Jones industrial average dropped 1% to 24964.75. The Nasdaq composite index slipped 0.1% to 7234.31. The dollar strengthening accelerated as bond yields rose: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.6% to 89.72. Futures on main US stock indices indicate mixed openings today.

Concern the Federal Reserve may raise rates more aggressively than previously thought is seen as the major driver of rising bond yields as the central bank prepares to auction $35 billion of 5-year notes and $29 billion of 7-year notes this week. Market participants will be watching closely for indication of any change in policy makers’ stance in Federal Reserve January 31 meeting minutes due today at 20:00 CET.

European stocks rebound

European stock indices rebounded on Tuesday as euro accelerated the slide against dollar. The British Pound extended losses against the dollar. The Stoxx Europe 600 rose 0.6% erasing Monday’s loss. The German DAX 30 closed 0.8% higher at 12487.90. France’s CAC 40 gained 0.6% while UK’s FTSE 100 slipped 0.01% to 7246.77. Indices opened mixed today.

The euro fell against the dollar and the Pound after report the European Parliament is preparing a resolution that would call for the UK to have single-market access. That would be a favorable development for the UK in its Brexit negotiations with the European Union and a break with EU negotiators’ position on Brexit. The news supported stocks as a weaker euro can help shares of European exporters, whose products become less expensive in overseas markets where clients purchase with their currencies whose value rises as euro’s value declines. In economic news economic sentiment in Germany declined in February but at less than anticipated pace, according to the ZEW survey.

Asian stocks advance

Asian stock indices are rising today after Monday pullback in thin trading with US and China’s markets closed. Nikkei recovered 0.3% to 211995 as yen extended losses against the dollar. Stocks rose as preliminary Japanese purchasing managers index reading at 54 in February indicated economic expansion, though it eased from 54.8 in January. China’s markets are closed and will resume trading on Thursday. Hong Kong’s Hang Seng Index is 1.6% higher. Australia’s All Ordinaries Index is up 0.05% with Australian dollar extending losses against the greenback.

Brent slide continues

Brent futures prices are lower today as dollar strength persists and traders expect rising US crude oil output. Prices fell yesterday: April Brent lost 0.6% to $65.25 a barrel Tuesday.

See Also