- Analytics

- Market Overview

US Stocks end higher for fifth straight session - 16.2.2018

Dollar falls fourth straight session

US stocks continued rising on Thursday. Dow Jones industrial average advanced 1.2% to 25200.37. The S&P 500 rose 1.2% to 2731.20. The Nasdaq composite jumped 1.5% to 7256.43. The dollar weakened fourth session in a row: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.4% to 88.588. Index futures point to higher openings today.

Concerns Federal Reserve may need to increase the pace of monetary tightening after January jobs report indicated rising wages seem to have subsided. Latest reports showing unexpected decline in retail sales in January and above expected initial jobless claims as manufacturing production remained steady while industrial production declined 0.1% in January suggest the economy is not yet overheating.

Mining shares lift European indices

European stock indices extended gains on Thursday led by Airbus shares. Both the euro and British Pound continued advances against the dollar. The Stoxx Europe 600 index rose 0.5% led by mining shares. Germany’s DAX 30 added 0.1% to 12346.17. France’s CAC 40 jumped 1.1% and UK’s FTSE 100 gained 0.3% to 7234.81. Indices opened 0.5%-0.7% higher today.

Airbus shares jumped 10% after report it delivered a record 718 planes in 2017 generating better than expected 2.95 billion euros ($3.68 billion) in free cash flow. Mining shares advanced on continued dollar weakness.

Many Asian market closed for Lunar New Year holiday

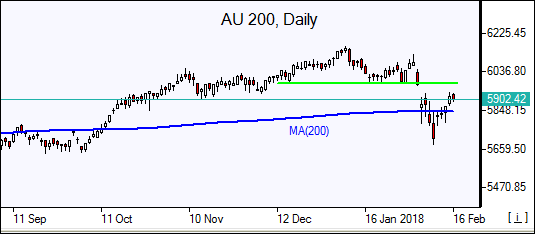

Asian stock indices are mixed. Nikkei rose 1.2% to 21720.25 despite continuing yen weakening against the dollar. Market sentiment was lifted by continued advances on Wall Street and re-nomination of Governor Haruhiko Kuroda to lead the Bank of Japan for a second term. Chinese markets are closed for the Lunar New Year holiday. Australia’s All Ordinaries Index is down 0.1% as Australian dollar accelerated its advance against the greenback.

Brent steady

Brent futures prices are steady today supported by weak dollar. Prices inched lower yesterday: Brent for April settlement lost 3 cents to close at $64.33 a barrel on Thursday.

See Also