- Analytics

- Market Overview

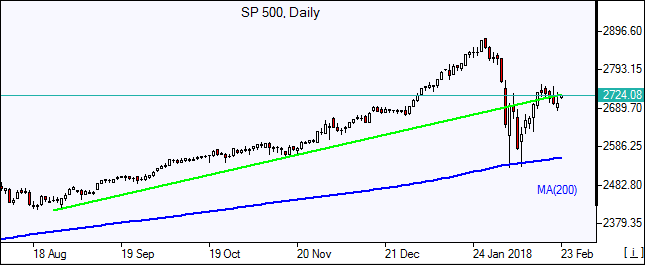

US indices end mixed - 23.2.2018

Dow, S&P 500 rise while Nasdaq slips

US stock indices ended mixed on Thursday after upbeat labor data. Dow Jones industrial average advanced 0.7% to 24962.48. The S&P 500 added 0.1% to 2703.96. However the Nasdaq composite lost 0.1% to 7210.09. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 89.732. Futures on main US stock indices indicate higher openings today.

Signs of uptick in inflation caused the stock market correction at the start of the month after jobs report showed wages grew at fastest rate in years. Markets have been in re-pricing mode after that as investors considered the likelihood of faster monetary tightening by the Fed to limit the risk of accelerating inflation. St. Louis Fed President James Bullard tried to tamp down the growing expectations that the US central bank will implement four quarter-point rate increases this year saying “the idea that we have to go 100 basis points in 2018, that seems like a lot to me”. Earlier the Fed’s vice chairman Randall Quarles said that recent low inflation readings aren’t “a great concern,” and the economy is “performing very well.” And Treasury yields inched lower yesterday with dollar following suit despite a 7,000 drop in initial US jobless claims to 222,000, the second lowest level since the end of the 2007-2009 recession.

European indices end mixed too

European stocks extended losses on Thursday. led by Airbus shares. Both the euro and British Pound turned higher against the dollar. The Stoxx Europe 600 index fell 0.2% paring earlier losses as US markets rebounded. Germany’s DAX 30 dipped 0.1% to 12461.91. France’s CAC 40 rose 0.1% while UK’s FTSE 100 fell 0.4% to 7252.39. Indices opened flat to 0.2% higher today.

Minutes from the European Central Bank’s January meeting were in focus yesterday. They showed officials thought it was “premature” to change ECB’s forward guidance as inflation remained too far from the ECB’s target of just below 2%. However, policy makers added that the forward guidance on quantitative easing could be revisited early this year, likely in the first half of the year. In economic news, the Ifo business climate index fell to below-expected 115.4 points in February, and UK’s fourth quarter GDP was downgraded to 1.4% from 1.5% annual rate.

Asian markets rebound

Asian stock indices are rising today tracking Wall Street gains overnight. Nikkei rose 0.7% to 21892.78 helped by yen growing weaker against the dollar and steady rise in core consumer price in January at 0.9% over year. Chinese stocks are rising paring earlier losses after news the government took control of acquisitive financial conglomerate Anbang Insurance: the Shanghai Composite Index is 0.6% higher and Hong Kong’s Hang Seng Index is up 1%. Australia’s All Ordinaries Index is up 0.8% as Australian dollar turned lower against the greenback.

Brent up on US inventory draw

Brent futures prices are building on previous day’s strength. Prices rose yesterday after Energy Information Administration reported crude oil stocks fell by 1.616 million barrels last week. Brent for April settlement rose 1.5% to close at $66.39 a barrel on Thursday.

See Also