- Analytics

- Market Overview

Tax reform worries drag US stocks lower - 16.11.2017

Energy shares lead SP 500 retreat

US major stock indices pullback accelerated on Wednesday as concerns about tax cuts reform undermined investors risk appetite. The dollar strengthened : the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 93.91. The S&P 500 fell 0.6% to 2564.62 led by energy shares. Nine out of 11 main sectors ended in the red. The Dow Jones industrial average lost 0.6% to 23217.28. Nasdaq composite declined 0.5% to 6706.21.

On Tuesday Senate linked the repeal of Obamacare individual mandate to its tax bill which made it more difficult to gain sufficient votes for passing. Concerns grew as Republican senator Ron Johnson said he wouldn’t vote for the tax package as it benefits big corporations more than smaller companies. The report retail sales rose 0.2% in October while no change was expected as inflation slowed to 2% in line with expectations raised the likelihood the Fed will raise rates at its December 12-13 meeting.

European stocks extend losses

European stocks continued retreating on Wednesday led by mining shares. The euro ended lower against the dollar while the British Pound added to gains. The Stoxx Europe 600 closed lower 0.5%. Germany’s DAX 30 lost 0.4% settling at 12976.37. France’s CAC 40 slipped 0.3% and UK’s FTSE 100 fell 0.6% to 7372.61.

Commodity shares sold off on lower demand concerns after data showed China’s industrial output slowed in October. China is a major consumer of metals and other commodities and strong Chinese demand for commodities is a driver for resource prices. Markets shrugged off further positive data after surprise German GDP report: euro-zone trade surplus increased in September.

Australia unemployment declines in October

Asian stock indices are mostly higher. Nikkei snapped the six-session losing streak adding 1.5% to 22351.12 as yen resumed the decline against the dollar. Chinese stocks are mixed: the Shanghai Composite Index is down 0.1% while Hong Kong’s Hang Seng Index is 0.7% higher. Australia’s All Ordinaries Index rose 0.2% on surprise decline in October unemployment to 5.4% while Australian dollar is little changed against the greenback.

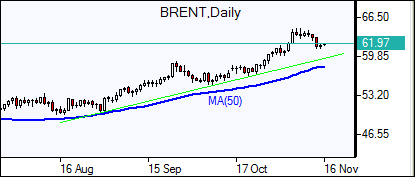

Oil higher despite US crude inventory build

Oil futures prices are rising today as traders bet OPEC will extend an ongoing output cut agreement during a meeting at the end of this month. Prices ended lower yesterday despite the US Energy Information Administration report domestic crude supplies rose by 1.9 million barrels last week. Gasoline stockpiles also rose 0.9 million barrels. January Brent crude fell 0.6% to $61.87 a barrel on Wednesday.

See Also